Services

Reports

We offer reports on the Argentine economic and financial situation, focused on key aspects such as the level of activity, fiscal accounts, inflation, interest rates and exchange rates.

Presentations

We make in-company presentations on the Argentine and international economic situation, adjusting to the client's needs.

Consultations

We are available for specific queries from our clients on current issues via phone or email.

Forecasting

We prepare detailed long-term economic forecasts and alternative scenarios for budgeting and decision making.

Contact Us

Last Reports

It seems that the government has no plans to remove FX restrictions in the short term. It also seems less likely that there will be a shock stabilization plan such as the Austral or Convertibility plan. We changed the exchange rate unification that we had projected in July to December. For the next few months, we think that the crawling peg will continue at 2% until the harvest ends and then there will be a slight acceleration. By the end of the year, we see a dollar of 1,600 pesos with the unified market. The magnitude of the FX spread will depend on whether the government relaxes the restrictions on the Blue-Chip Swap or not. In the first case it can rise more than in the second.

- weekly

Support for Reforms in the Lower House, More Rate Cuts and Less Subsidy Cuts

Articles

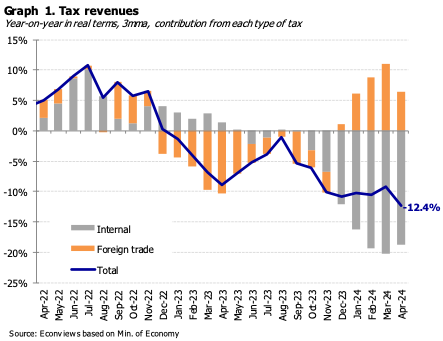

Más rápido de lo que muchos economistas esperaban, el Gobierno va consolidando su objetivo de cerrar el año con déficit fiscal cero, mejora de las cuentas del Banco Central, y camino a la tasa de inflación de un dígito porcentual….

About Us

Graduate in Economics from the University of Buenos Aires and Ph.D. in Economics from Columbia University. Professor and researcher at the Di Tella University and academic advisor at FIEL

With vast experience as an advisor to multilateral organizations such as the IMF, the World Bank and the Inter-American Development Bank, as well as several Latin American countries, he held prominent roles in the financial sector, including the presidency of Banco Hipotecario S.A. and functions in the Ministry of Economy and the Central Bank of the Argentine Republic.

He was an Assistant Professor at the University of Maryland, and taught at institutions such as CEMA, Georgetown University, and Columbia University.

He is a columnist and author of numerous articles in international publications. Author of the book “The Argentine economic crisis, a history of adjustments and imbalances” with Sebastián Kiguel.

Graduate in Economics from the University of Buenos Aires and Master in Finance from the Torcuato Di Tella University. He has been an adjunct professor at UBA since 2002 and a visiting professor at UTDT since 2006.

He was chief economist for Argentina at BTG Pactual and economist for South America at the British Embassy based in Buenos Aires.

He was an economic journalist at Clarín and El Economista and was a member of the boards of directors of various companies.

Author of the book “Puede fallar: Economía y comunicación en 40 años de democracia” with Gabriel Llorens Rocha.

Author of the podcast “La economía en 3 minutos.”

Alejandro Giacoia

Economist

Bachelor of Economics (UBA).

Pursuing a Master’s Degree in Finance (Di Tella).

Delfina Colacilli

Economist

Bachelor of Economics (UBA).

Studying a Master’s Degree in Economics (UBA).

Rafael Aguilar

Economist

Bachelor of Economics (UBA).

He was an assistant in the UBA National Accounts chair

Pamela Morales

Economist

Bachelor of Economics (UCEMA)

Associate Professor of Macroeconomics UCEMA.